Rampgreen Solutions Pvt Ltd. v CIT, Delhi HC,2015

Introduction

This case law discusses the scope of functional differences filter while carrying out a comparability study for comparables within the same industry sector. The case law has elaborated how companies engaged in Knowledge Process Outsourcing (KPO) services cannot be used as comparables for conducting a Transfer Pricing study of a company engaged in Business Process Outsourcing (BPO) services, even though both KPO and BPO services fall within the broader definition of Information Technology Enabled ServicesSector.

Facts of thecase

The assessee is a wholly owned subsidiary of its AE. It is engaged in providing voice based customer care to the AE’s clients. The assessee renders call centre services which fall within the broad description of Information Technology Enabled Services(ITES).

For the assessment year under consideration, the Transfer Pricing Officer (TPO) made a substantial addition to the income vide transfer pricing adjustments. One of the reasons for the addition was inclusion of Vishal Information Technology Ltd. and eClerx Services Ltd. as comparables by theTPO.

The assessee contested the inclusion of the aforementioned two companies as comparables on the ground that the same were engaged in Knowledge Process Outsourcing (KPO) services whereas the assessee was engaged in Business Process Outsourcing (BPO) services. Companies engaged in providing KPO services earn a higher margin in relation to companies engaged in providing BPO services, therefore, KPO service providers and BPOservice providers cannot be comparable.

The assessee’s grounds for non – inclusion of Vishal Information Technology Ltd. and eClerx Services Ltd. was rejected both at the DRP and ITAT level, holding that both the comparables were engaged in providing ITES, as the assessee also can be characterised as an ITES, the comparables cannot be excluded on the basis of functionaldifferences.

Key Arguments of the Ld. Counsel for theAssessee

- KPO could not be included as comparables for the purposes of benchmarking studies. As KPO although ITES, the nature of service was materially different from the services rendered by the Assessee which was aBPO

Key Arguments of theRevenue

- Both eClerx and Vishal are engaged in providing ITES and once a service falls within that category (ITES) then no sub-classification of the segment waspermissible

- Also comparability analysis by Transaction Net Margin Method (TNMM) method is less sensitive to certain dissimilarities between the tested party and thecomparables

- In Willis Processing Services (I) (P.) Ltd. v Dy. CIT 30 ITR (Trib) 129 (Mumbai) 2014, it was held that, no distinction could be made between KPO and BPO serviceproviders

Decision of the HighCourt

According to the Tribunal, no differentiation could be made between the entities rendering ITES. The hon’ble Delhi High court did not accept this view as it is contrary to the fundamental rationale of determining ALP. ITES encompasses a wide spectrum of services that use Information Technology based delivery. Such services could include rendering highly technical services by qualified technical personnel, involving advanced skills and knowledge, such as engineering, design and support. While, on the other end of the spectrum ITES would also include voice-based call centres that render routine customer support for their clients. Clearly, characteristics of the service rendered would be dissimilar. Further, both service providers cannot be considered to be functionally similar. Their business environment would be entirely different, the demand and supply for the services would be different, the assets and capital employed would differ, the competence required to operate the two services would be different. Each of the aforesaid factors would have a material bearing on the profitability of the two entities. Treating the said entities to be comparables only for the reason that they use Information Technology for the delivery of their services, was held to beerroneous.

Rule 10B(2)(a) of the Income Tax Rules, 1962 mandates that the comparability of controlled and uncontrolled transactions be judged with reference to service/product characteristics. This factor cannot be undermined by using a broad classification of ITES which takes within its fold various types of services with completely different content and value. Thus, where the tested party is not a KPO service provider, an entity rendering KPO services cannot be considered as a comparable for the purposes of Transfer Pricinganalysis.

Conclusion

This judgement of the High Court elaborates on the use of the functionality filter for excluding comparables where a comparable may fall within a broad industry category but however the comparable maybe higher up the value chain such as KPO service providers in the case law discussed supra in relation to the tested party, the assessee, which was a BPO service provider, where both KPO and BPO functions fell within the broader industry classification ofITES.

Also this case law highlights the significance of functionality filter when transactional profit methods (TNMM) are used to arrive at the Arm’s Length Price, where these methods are known to be less sensitive towards differences in characteristic of property or servicesoffered.

The clarity arising from this order will be useful to assessees in various industries. Just to give an example, in case of the Pharma industry in this country a generic drug manufacturer can exclude a brand name drug manufacturer as a comparable, all other conditions remaining equal, while conducting its Transfer Pricing analysis for arriving at Arm’s LengthPrice.

Johnson Matthey India Pvt Ltd. v DCIT, Delhi HC,2015

Introduction

This case law sheds light on the treatment of pass through costs in case of transfer pricing analysis from the perspective of Indianjudiciary.

Facts of thecase

- The assessee is a manufacturer of Automotive Exhaust Catalyst, which are used to control emission of pollutants byautomobiles

- The assessee manufactures catalyst on behalf of Maruti Udyog Limited (MUL) and supplies the same to vendors ofMUL

- The manufacturing of Catalyst requires inputs of precious metals such as Platinum, Palladium, etc. as rawmaterials

- The precious metals (PGM) required as inputs were procured by the assessee from its Associated Enterprise (AE) located inUK

- During scrutiny assessment the TPO made substantial addition by way of transfer pricing adjustment using the PLI Operating Profit/OperatingCost

- The assessee appealed against this adjustment arguing that the PLI to be used is Operating Profit/(Operating Cost – Raw Material Purchase Cost) as raw material purchases were pass through cost, which ground was rejected at the ITAT level therefore this matter is before the HighCourt

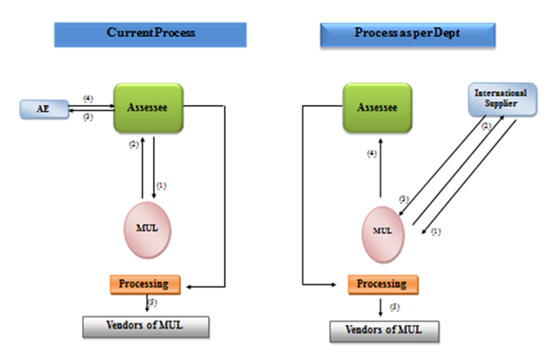

- Following diagram indicates the purchase mechanism arrangement between assessee and MUL and also the process which had to be adopted in the view of the revenue to uphold assessee’sargument:

|

Key Arguments of the Ld. Counsel for theAssessee

The assessee operates on a fixed manufacturing charge per unit model, being a contract manufacturer. The assessee’s profit margin was dictated by the negotiations with MUL. The assessee cannot possible earn a profit based on a percentage of the raw material used in manufacturing. The assessee has to procure raw material on the instructions of MUL, at a price dictated by it and from the source selected by MUL. If MUL had bought PGM directly from the AE, there would have been no application of transfer pricing as MUL and AE were unrelated entities. MUL would have purchased PGM at the negotiated prices, as the assessee was doing presently. Therefore, the price at which assessee purchased PGM from AE are already at arm’s length. It was only for administrative convenience (emphasis supplied) that MUL has outsourced its function of purchase of raw material to the assessee but still controlled every element of such raw material, i.e. quantity, price, mode of purchase(spot/forward).

Also the assessee does not bear any risk in relation to the cost of raw material. The assessee does not even bear credit risk in relation to the cost of PGM as the credit period given by AE to assessee for PGM was 60/90 days, while the credit period given by the assessee to MUL’s vendors was 30 days wherein MUL guaranteed payment to theassessee.

Key Arguments of theRevenue

The purchase of PGM by the assessee from the foreign AE was not a pass though cost transaction since the sale of raw material was not directly made by AE to MUL but it was a sale first made to the assessee which in turn sold it to vendors of MUL. Also a true pass through cost would have been where the purchasers of the final product viz. the automotive catalysts would themselves purchased the raw materials, handed it over to the assessee as a bailee to utilize it in the manufacture of the products and then purchase the final product by paying to the assessee a price perunit.

Decision of the HighCourt

The exclusion of pass through costs from the denominator of total costs where the financial ratio of Operating Profit to Total Cost is used is acknowledged in para 2.93 and para 2.94 of the OECD Guidelines. The very purpose of transfer pricing is to benchmark transactions between related parties in order to discover the true price if such entities were unrelated. If MUL had bought the PGM directly from the foreign AE there would have been no application of transfer pricing since MUL and AE are unrelated parties. MUL would have purchased the PGM just like the assessee did on negotiated prices. There is merit in the contention that the prices at which the assessee purchased PGM from AE were already at arm’s length and that it was for administrative convenience that MUL had outsourced this function to assessee. Therefore the addition, directed to be made by the Assessing Officer to the income of the assessee for the AY in question isdeleted.

Conclusion

This ruling of the High Court will aid in conducting of transfer pricing analysis, where the tested party is a contract worker and has incurred pass through costs, then if the Profit Level Indicator (PLI) being used for comparison is Operating Profit/Total Cost, pass through costs could be excluded from the denominator of thePLI.